Is the California LLC the BEST WAY to Protect your business or yourself in California?

Probably Not.

This is a controversial issue, with Proponents and Opponents on both sides. This is my opinion after researching the topic. However, let’s first look back into history regarding the LLC.

The Family Limited Partnership has been used in many jurisdictions for many years. This entity has been used as an excellent asset protection entity in most states for many, many years. The one issue that some would have with the Family Limited Partnership (FLP), or just Limited Partnership (LP) is the fact that the Limited Partners could be protected from creditors, with what is called the Charging Order Rule, but there was the liability issue of the General Partner, or Partners. However, that power is many times more an opportunity than an actual implementation. We have rarely seen a creditor move for a Charging Order, partly because such a creditor will be hit with phantom income from the California LLC or FLP, and that is a painful cost for the creditor to bear: taxable income without cash.

Unfortunately, from time to time, the courts would allow creditors to come after the General Partners. Over the years, we would work to limit this issue by issuing only a small piece of the Limited Partnership to the General Partner or other such tactics. Unfortunately, the courts, currently, are now much more frequently allowing creditors to bring their judgements against these General Partners, which has caused us to take different tactics.

Then, an entity called a Limited Liability Company (LLC), (not Limited Liability Corporation) was created to eliminate the “General Partner” potential liability issue. Now, in most states, the LLC affords the same Charging Order benefits to all members as does the LP, and since there is no General Partner, as in the LP, that liability issue is reduced, if not eliminated, significantly.

In 1997, after almost all other states had adopted LLC rules, California adopted its own LLC rules and allowed a selected number and type of business to use this new business entity. The whole legal community was excited to finally have in our own state what others had been able to use for years.

However, when we received the new regulations about how LLCs would be able to be used in California, many were disappointed. Not to mention Gross Revenues Taxes and limitations on what kind of business could use it. Liability benefits were not up to what many of us were hoping for. Such as, if you have an interest in a California LLC and a creditor comes after you with a judgment, the first step the creditor must take is to get the judge to issue a Charging Order. That means that your membership interest in the California LLC is charged with the payment of the creditor’s judgment. Of course, since you and your family control the California LLC, you would cut back or eliminate any LLC distributions of profits so that the creditor gets little or nothing, and the Charging Order will remain unsatisfied. In other words, you control what the creditor will get paid.

One major problem with the California LLC is that there is another theory of recovery. In actuality, the judgment creditor in California can ask the court to allow the creditor to foreclose on the membership interest. So a California LLC would not have the charging order protection, but could possibly close down and the assets in the partnership made available to the creditor. By contrast, the laws of 15 other states, such as Nevada, Delaware, South Dakota and Wyoming, only allow the creditor to get a charging order. So, in actuality, creditors in California have more power over LLCs then in some other states.

This, in conjunction with the other issues with a California LLC, law forces us, when determining in what jurisdiction to form our LLC, to remember: A California LLC may not provide the charging order protection we may desire, whereas 15 other states do offer such protection.

There is also the argument that Charging Order protection follows an individual; not the LLC or jurisdiction where it is created. In such a case, a California resident would not acquire Nevada charging order protections by forming an Nevada LLC. Under this argument, only Nevada residents would be entitled to the charging order protections under their own, or Nevada law. This is an issue you would want to discuss with your legal advisor.

SOME SPECIFICS:

The general rule in all states, including California, is that the money or property of an LLC cannot be taken by creditors to pay off the personal debts or liabilities of the LLC’s owners. Similar to corporations, the money or property held in an LLC belongs to the LLC, not the members/owners individually, and may not be applied by creditors to pay a member’s individual debts. This protection from personal creditors is one of the key reasons people form LLCs. In addition to providing LLC members with personal liability protection from the LLC’s business debts, the LLC also protects the business and its owners from exposure to any debts or personal liability the other LLC members/owners may incur that are unrelated to the LLC’s business.

CALIFORNIA LLCS AND CHARGING ORDERS

Like all states, California allows creditors of LCC members to obtain a charging order to collect on a judgment obtained against an LLC member. A charging order directs the LLC to pay to the creditor any distributions of income or profit that would otherwise be distributed to the LLC debtor/member’s. Like most states, creditors with a charging order in California only obtain the ‘financial rights but the creditor take the role of the limited partner therefore cannot participate in the LLC’s management.

Since a creditor with a charging order cannot participate in the LLC’s management, it cannot order the LLC to make a distribution or that the LLC be sold to pay off the debt. Frequently, creditors who obtain charging orders against LLCs end up with nothing because they can’t order any distributions and the LLC can choose not to make any.

Example: John, Meghan, and Louis form a California LLC to operate their retail business. John, a big spender, owes $38,000 on his personal credit cards. When he doesn’t pay, the accounts are turned over to a collection agency which obtains a $38,000 court judgment against him. While the collection agency can attempt to collect on the debt from John’s personal assets, it cannot take money or property owned by the LLC. For example, it cannot get any of the money held in the LLC’s bank account.

Although a charging order is often a weak remedy for a creditor, it is not necessarily toothless. The existence of a charging order can make it difficult or impossible for an LLC debtor/member or the other owners (if any) to take money out of an LLC business without having to pay the judgment creditor first.

CREDITORS MAY FORECLOSE ON CALIFORNIA LLC MEMBERS

Unlike many other states, California’s LLC law does not provide that a charging order is the exclusive remedy of LLC members’ personal creditors. Rather, it allows a creditor to foreclose on the debtor/member’s LLC interest. Under this procedure, a court orders that the debtor/member’s financial rights in the LLC be sold.

The buyer at the foreclosure sale—often the creditor or other members of the LLC–becomes the permanent owner of all the debtor/member’s financial rights, including the right to receive money from the LLC or obtain a share of the LLC’s assets if it is dissolved. However, the buyer may not participate in the management of the LLC or order that any distributions of money or property be made.

As a practical matter, getting a debtor/member’s LLC interest foreclosed upon can be an expensive and difficult undertaking; but, the ability to do so gives a creditor more leverage in dealing with the debtor. Often, the debtor/member or other LLC members will settle the claim to prevent the foreclosure.

Example: The collection agency obtains a $38,000 judgment against John, co-owner of the web design LLC, for his unpaid credit card debts. The agency obtains a charging order from a California court ordering the LLC to pay over to it any profits it distributes to John up to $50,000. However, the LLC need not, and does not, make any distributions, so the agency gets nothing. The agency then obtains a court order for the foreclosure on John’s interest in the LLC. To avoid this, the LLC settles John’s personal debt with the agency for $38,000. Like most states, California does not, however, permit personal creditors of an LLC member to have a court order that the LLC be dissolved and its assets sold to pay off the creditor.

WHAT ABOUT ONE-MEMBER CALIFORNIA LLCS?

The reason personal creditors of individual LLC owners are limited to a charging order or foreclosure is to protect the other members (owners) of the LLC. It doesn’t seem fair that they should suffer because a member incurred personal debts that had nothing to do with their LLC. Thus, such personal creditors are not permitted to take over the debtor/member’s LLC interest and join in the management of the LLC, or have the LLC dissolved and its assets sold without the other members’ consent.

This rationale disappears when the LLC has only one member (owner). As a result, court decisions and LLC laws in some states make a distinction between multi-member and single-member LLCs (SMLLCs). California is not one of these states. Nevertheless, whether, and to what extent, California SMLLCs are protected from outside creditors is not entirely clear. Moreover, in some cases the laws of other states that provide less protection to SMLLCs may be applied–for example, where a California SMLLC does business or owns property in another state. In addition, the protections that state LLC laws provide to SMLLCs might be ignored by the federal bankruptcy courts if the SMLLC owner files for bankruptcy.

If you are really concerned about protecting the assets in your California SMLLC against personal creditors, you should consider adding another member to your LLC. If you decide to do this, the second member must be treated as a legitimate co-owner of the LLC. If the second owner is added merely on paper as a sham, the courts will likely treat the LLC as an SMLLC. To avoid this, the co-owner must pay fair market value for the interest acquired and otherwise be treated as a “real” LLC member—that is, receive financial statements, participate in decision making, and receive a share of the LLC profits equal to the membership percentage owned.

SHOULD YOU CONSIDER FORMING YOUR LLC IN ANOTHER STATE?

You do not have to form your LLC in California even if it is the state where you live or do business. You can form an LLC in any state–for example, even though your business is in California, you could form an LLC in Nevada because it has a very debtor-friendly LLC law. As a general rule, the formation state’s LLC law will govern your LLC. Thus, forming an LLC in a state with a favorable LLC law could provide you with more limited liability protection than forming it in California. However, doing so will increase your costs because you’ll have to pay the fees to form your LLC in the other state plus the fees to register to do business in California.

So should you shop around for the state that provides the most limited liability to LLC owners? If limiting liability is extremely important to you, you may want to form your LLC in a state like Nevada, Delaware, or Wyoming that have very debtor-friendly LLC laws. But there is no guarantee that California or other courts in other states will always apply the law of the state where you formed your LLC, rather than the less favorable California LLC law. This is a complex legal issue with no definitive answer. Consult an experienced business lawyer for more information.

OTHER ISSUES WITH CALIFORNIA LLCS.

As mentioned above, another issue that many are not excited about is the rule that an LLC in the state of California is the rule that if the LLC makes a certain amount of Gross Business, then the LLC must pay a TAX on the Gross Revenues, while other entities only pay tax on Profits.

Also, did you know that there are dozens of activities that cannot be provided as a LLC in California?

Most states permit professionals to render services through a professional limited liability company. But that’s not the case in California. In California, professional services may be rendered by a professional corporation, or perhaps, in very limited cases, an LLP (Limited Liability Partnership) but not by a LLC.

The lunacy is that dozens of other kinds of businesses are also prohibited from forming LLCs. Basically, if the business has to be licensed in California, it can only be operated as a LLC if the statute expressly permits it.

There are a lot of occupations that must be licensed in California. To determine whether someone can render services through an LLC in California boils down to these three questions:

- First, do you have to be licensed, certified, or registered under the Business and Professions Code or one of the other statutes to provide the services legally in California? If not, then you can provide the services through an LLC.

- Second, if you are required to be licensed, certified, or registered, then are the services “professional services,” (e.g., accounting, law, medicine). If so, then you cannot provide the services through an LLC.

- Third, if you are required to be licensed, certified, or registered but the services are nonprofessional, then you can provide the services through an LLC if the Business and Professions Code or one of the other statutes specifically says you can; otherwise, you cannot provide the services through an LLC.

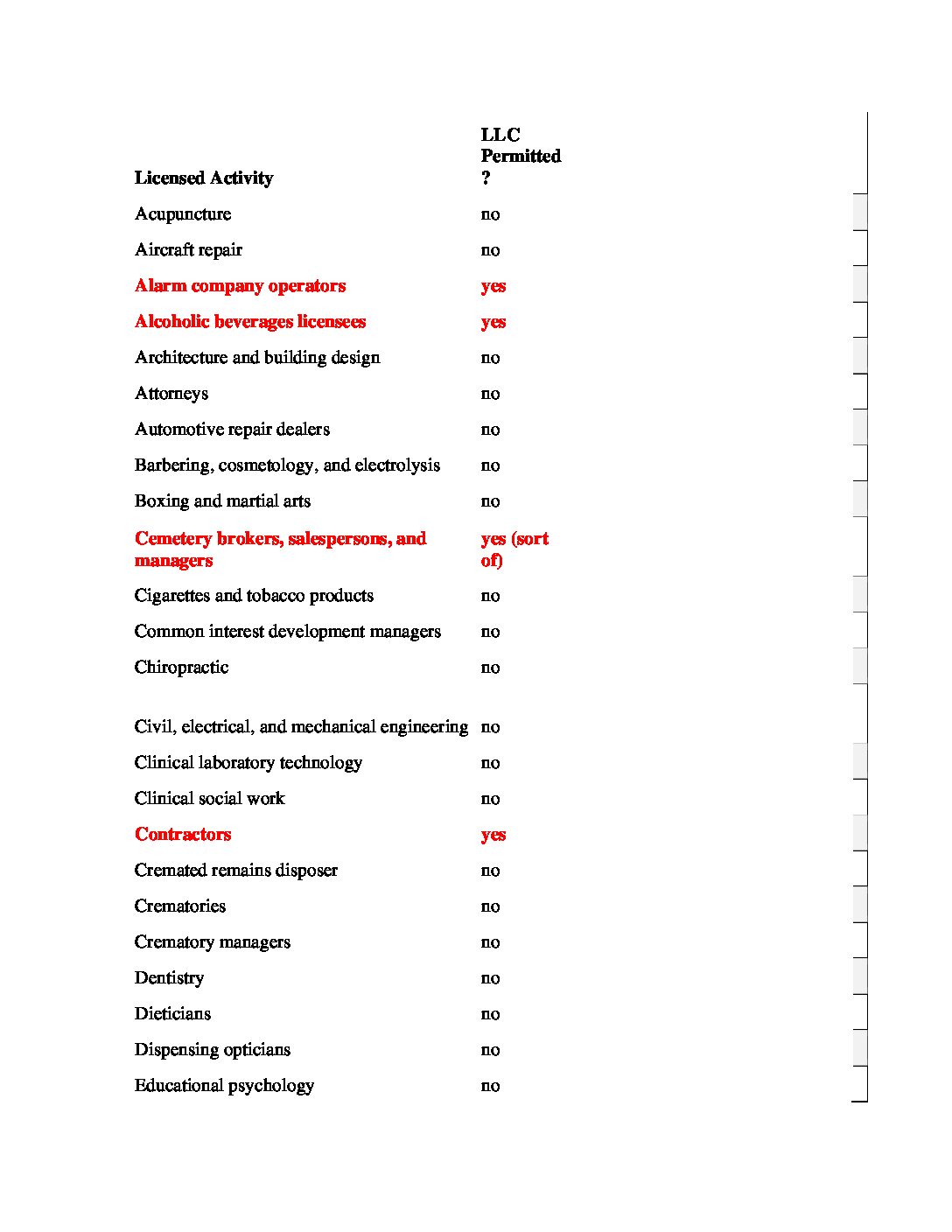

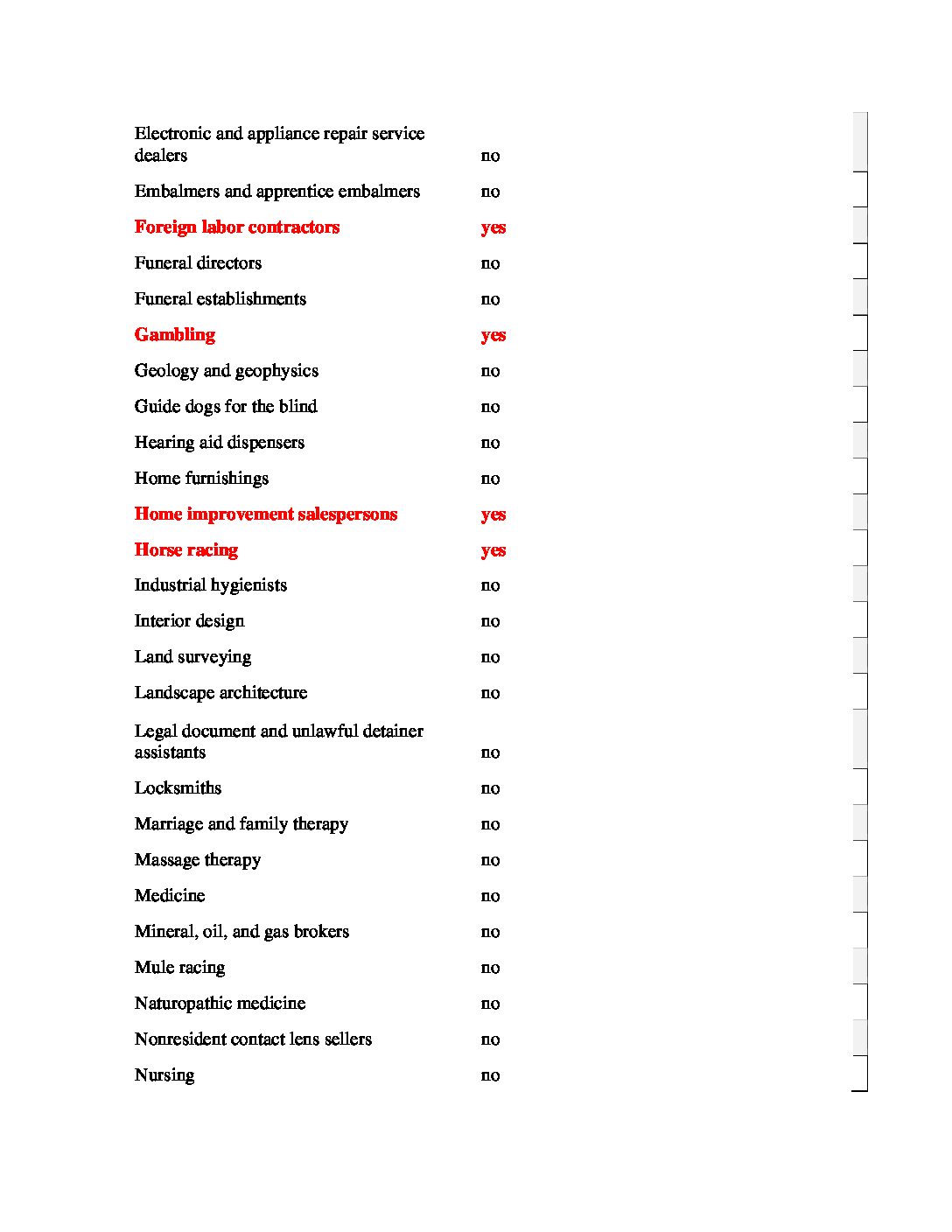

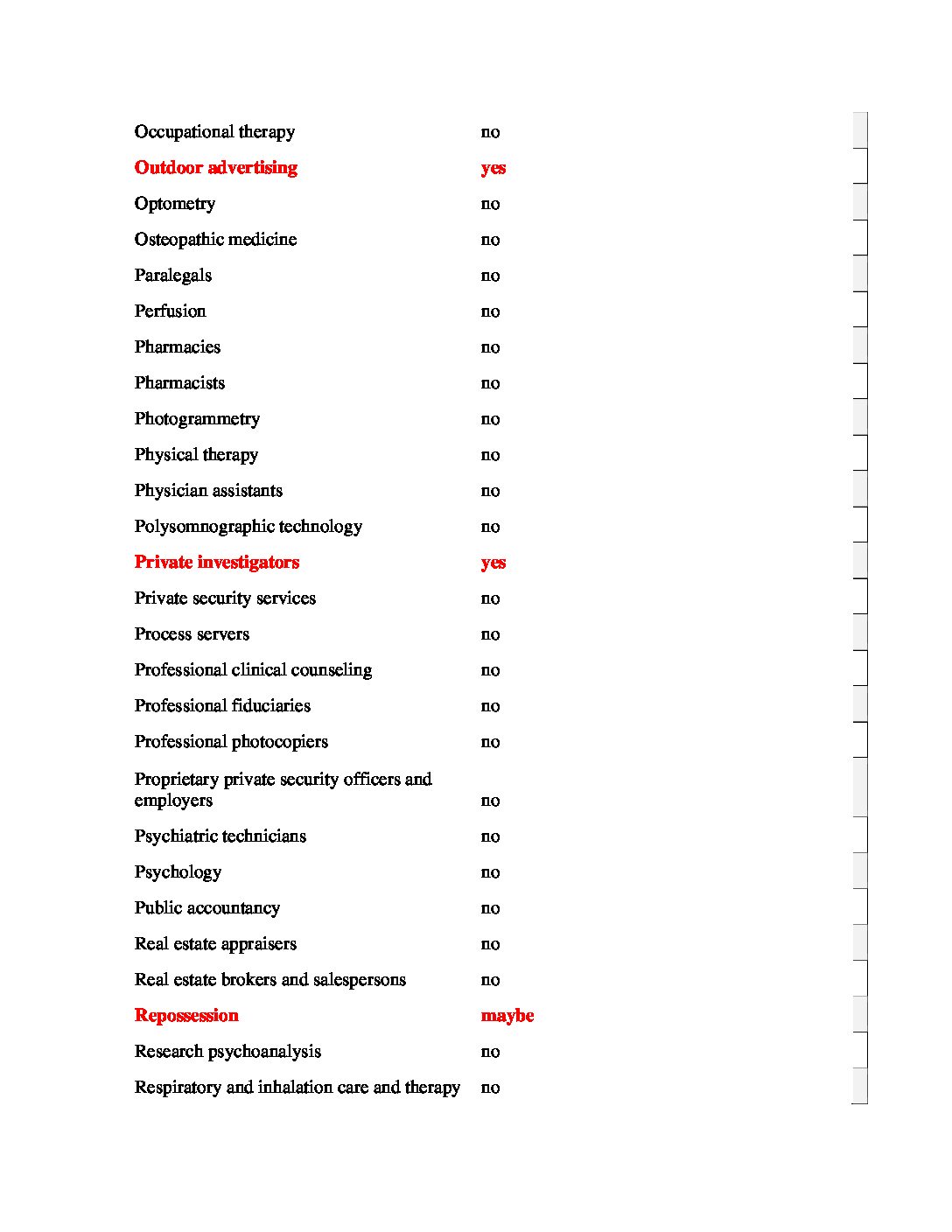

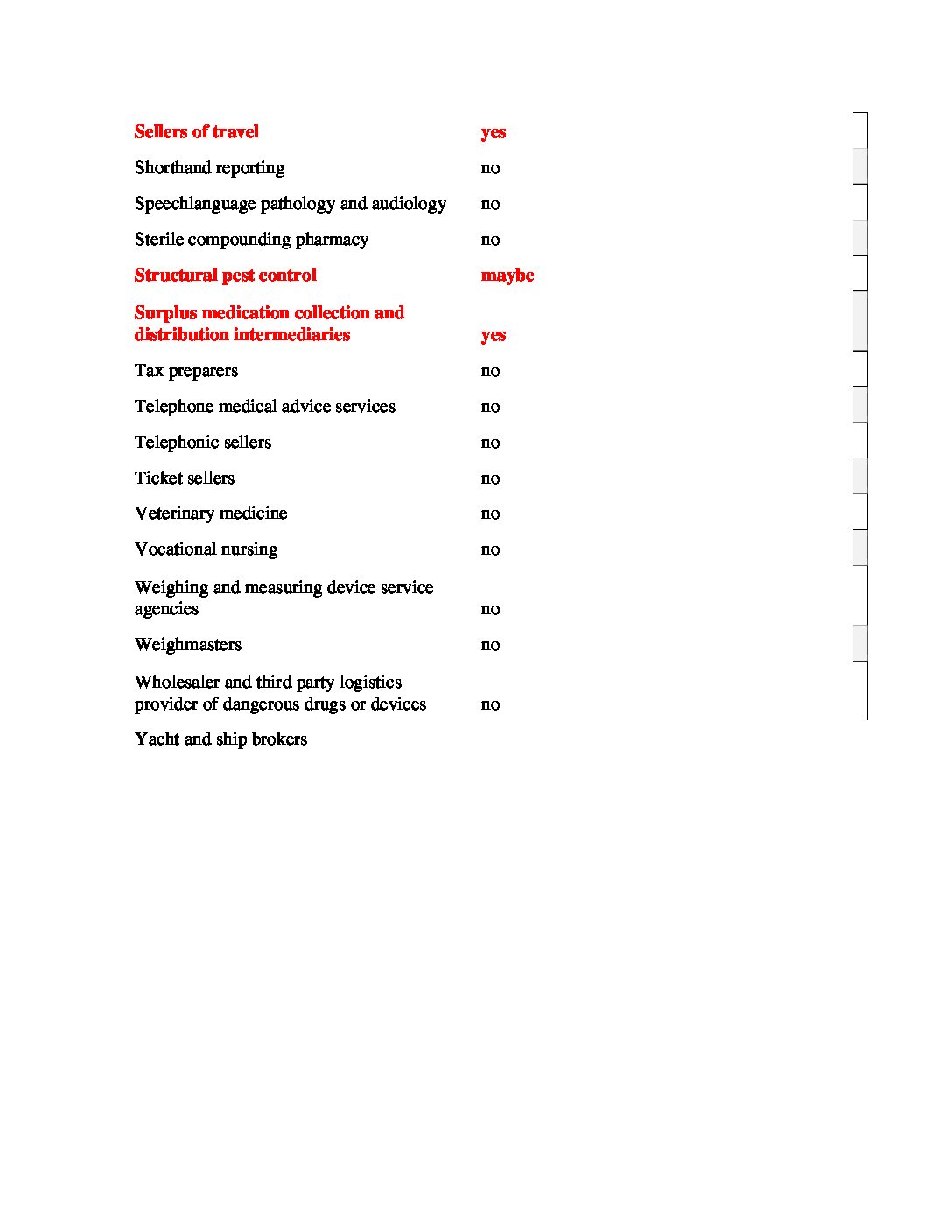

We found 93 professions, occupations, or services that have to be licensed in California.

This means that there are many businesses and occupations that require license under California law that cannot operate as LLCs. It’s a bizarre list that would make anyone wonder why the legislature cares!